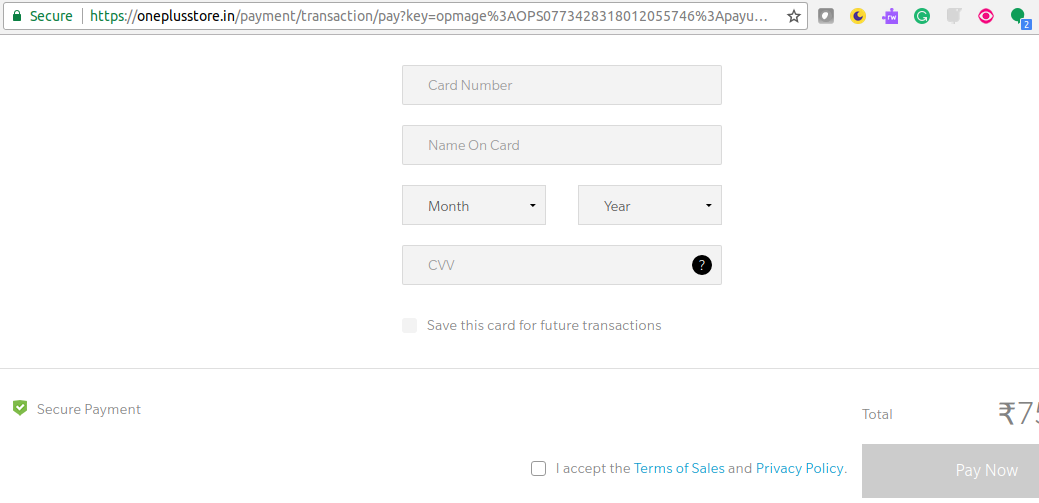

WHERE TO FIND YOUR CARD’S SECURITY CODE Every credit card has a security code used to help verify that the card is in your possession. Here are the codes’ locations on American Express, Discover, Mastercard and Visa cards: It doesn’t matter what you call them – a card security code (CSC), card verification value (CVV or CV2), card verification code (CVC) or even a card code verification (CCV) – those three or four digits provide an additional measure of credit card security when you make purchases online, by mail or over the phone. But, finding them can be confusing, especially if you’ve never made an online purchase with that specific card. WHERE TO FIND YOUR CARD’S SECURITY CODE Every credit card has a security code used to help verify that the card is in your possession. Here are the codes’ locations on American Express, Discover, Mastercard and Visa cards: The card security code “is one in a series of steps that merchants can take to prevent fraud and verify that the order is being placed by the actual cardholder,” says Matthew Towson, director of community affairs for Discover Financial Services, adding that in most cases, the only way for a cardholder to provide the security code is to actually be in possession of the card. Where you find the depends on the card. Carbon Coder 3.20. If you have a, or, turn the card over.

In the signature box or just to the right of it, you will see a series of digits. However long the series, the final three digits are the security code. Cardholders can find their security code on the front of the card, either to the left or right of the embossed 15-digit card number. These four digits are printed in black, not embossed. Even as the U.S. Payment system continues its migration to, security codes will still be printed and used the same way they are now, according to Doug Johnson, vice president of risk management policy for the American Bankers Association. “For consumers who are conducting online transactions, it’s still an important security measure to have,” he said.

Every credit card has a card security code printed on it. It may be called a CSC, a card verification value (CVV or CV2), card verification code (CVC) or card code. If you’ve ever used your credit card online, or over the phone, you’ve probably been asked for something known informally as the “short code” or “security.

Even with chip cards, “the goal is not to move away from other important security measures that help protect consumers.” If you can’t read the security code for any reason, call the issuing financial institution on the customer service number listed on the back of your credit card. Each financial institution will have its own guidelines for how to handle illegible security codes, but it may require reissuing the card. Since the security code is a safety feature, just like your PIN, you will want to protect it. Generally, as long as you have a secure connection, you can safely provide it during online transactions. The merchant is prohibited, for security purposes, from storing the code.

However, never provide your security code to anyone, whether you know the individual or not, and never include it in an email (email is unsecured communication). Once someone else has your security code, card number and card expiration date, it will appear to an online merchant that someone else, not you, is actually in possession of the card. See related:.